Crude Oil Slummed Back Below $ 49 A Barrel in New York

27 February 2020

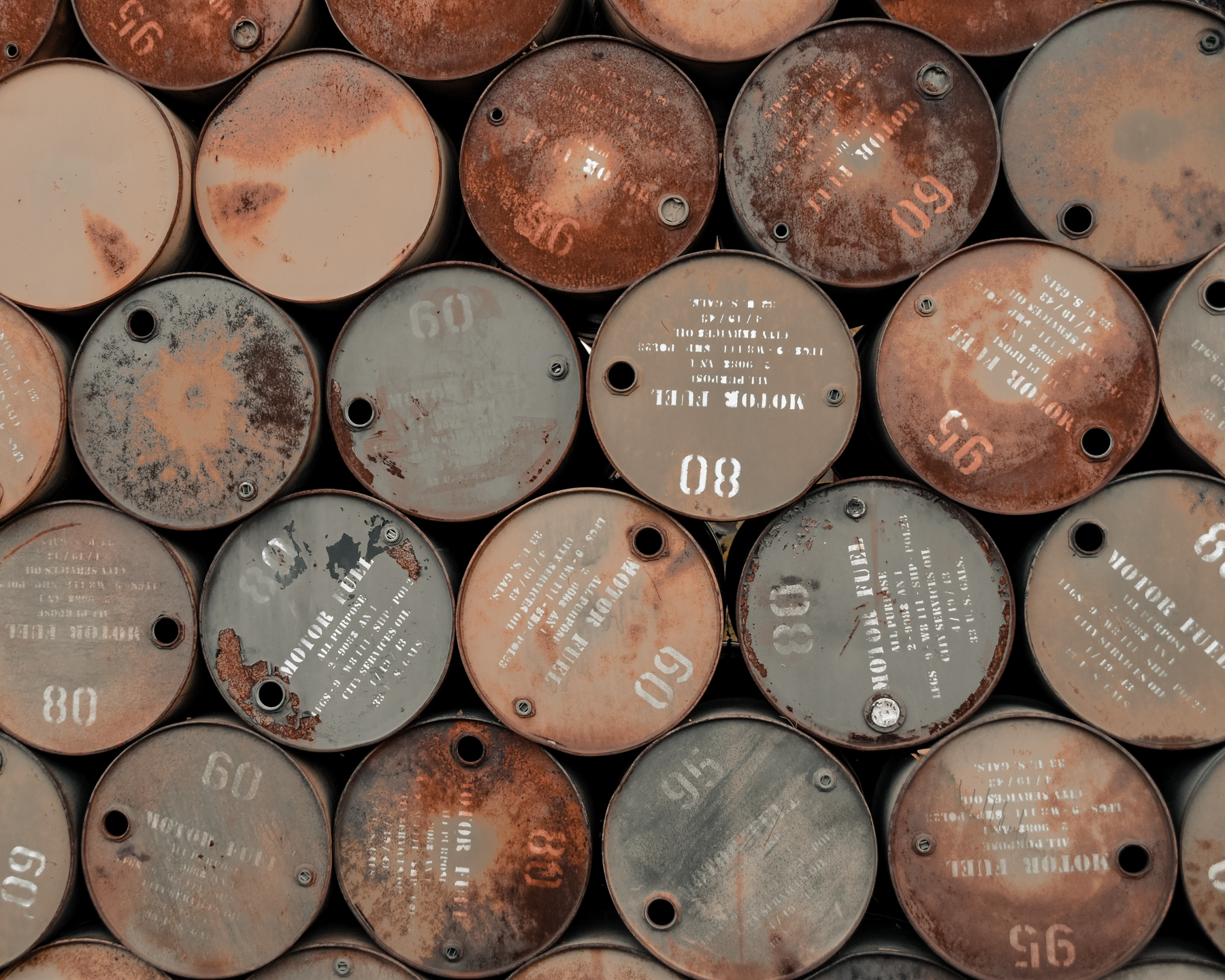

TREASURIES EXTENDED THEIR WEEKLONG ADVANCE DUING U.S. After Following a Report that Health Officials in Nassau County, A New York City Suburb, Are Monitoring 83 people who have visited mainland China or may have come in contact with the Coronavirus. Earlier gains were fuled by the german health minister`s commenting an epidemic in the country. Yields across the curve declined for a fifth straight day led by front-end, steepening 2s10s by 4bp; 10-Year Yields declined as much as 5.3bp to record low 1,299% before stabilizing near 1.33%. (Bloomberg) Stocks in Asia Looks Set for a Cautionus Start on Thursday After a Rocky Session on Wall Street that SAW Treasury Yields Hit New All-Time Lows and Declines in U.S. Shares. The S&P 500 Slipped Index, Bringing Its Five-Day Retreat to 8%, as concerned Mounts that the spread of Coronavirus into the World`s Largest Economy Could Curb Growth. Microsoft Corp. Fell in After-Hours Trading After Saying the virus continuous to impact its supply chain in China. The Australian Dollar Tumbled to a Fresh 11-Year Low. Elsewhere, traders will be watching the bank of kore’s policy decision thursday. Meantime, Industrial Metals and Minerals Mostly Dropped, Including Copper and Iron Ore. Crude Oil Slummed Back Below $ 49 A Barrel in New York. (Bloomberg) Source: Danareksa Securities Debt Research Photo by Waldemar Brandt on Unsplash