Market Digested the Potential Ramifications of a U.S. airstrike

06 January 2020

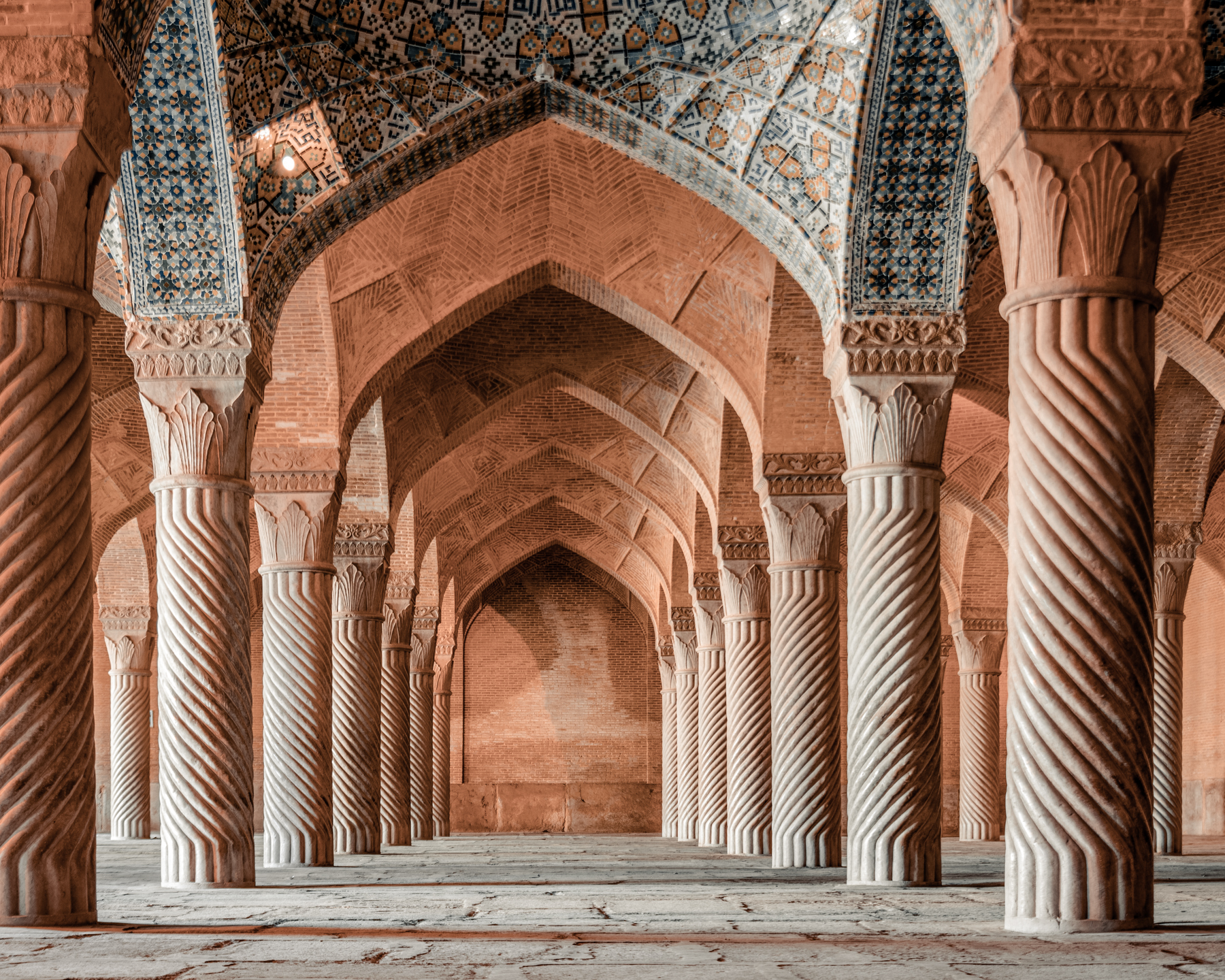

It`s a rough start to the year for the bearish bond traders, as an abrupt escalation in u.s.- iran tensions have center investors retreat to the safety of treasuries. Benchmark Yields Tumbled Friday, Driving the Curve Flatter, As the Market Digested the Potential Ramifications of a U.S. airstrike that killed one of Iran`s top generals. Iran’s Vow of Retaliation, Coming on Top of North Korea`s Jan. 1 Threat of "Shocking" Action to Avenge American Sancission, Puts Geopolitical Angst and Center Even Before Many Investors Have Returned from the New Year Holidays. And those anticipating cheerier news on the economic front faced disPAINTMENT from the Worst U.S. Factories Data since 2009. (Bloomberg) Oil Extended its Dramatic Price Surge from Friday as the Fallout between the U.S. and Iran Escalated after the assassination of one of the Islamic Republic`s most powerful generals. Futures are up about 6% since Friday, trading above $ 70 A barrel. In London, as the U.S. State Department Said There`s "Heightened Risk" of Missile Attacks near Military Bases and Energy Facilities in Saudi Arabia. Iran Said on Sunday it No Longer Cononsiders itself Bound by the 2015 Nuclear Deal Negotiated with the U.S. and other world powers in the Fallout from the killing of general qassem soleimani. (Bloomberg) Source: Danareksa Securities Debt Research Photo by Faruk Kaymak On Unssplash